BAI Index: It’s all about perspective: A muted peak is in the cards

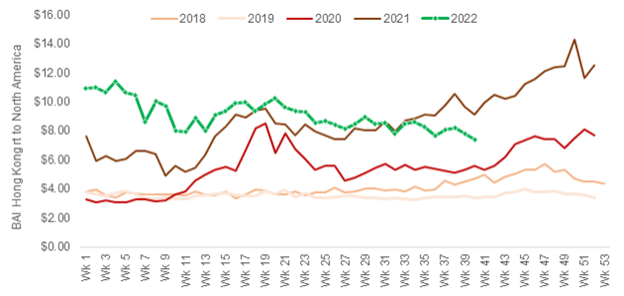

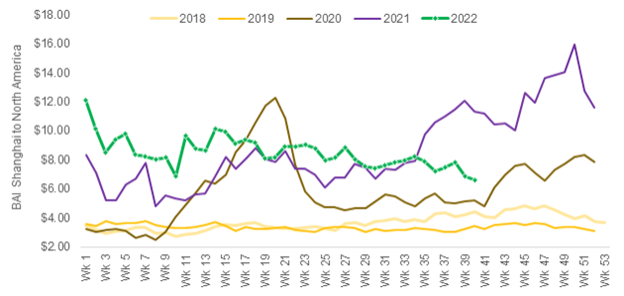

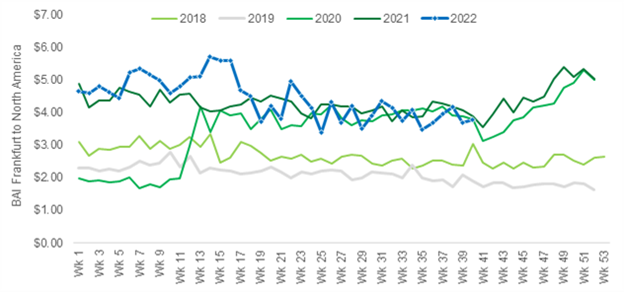

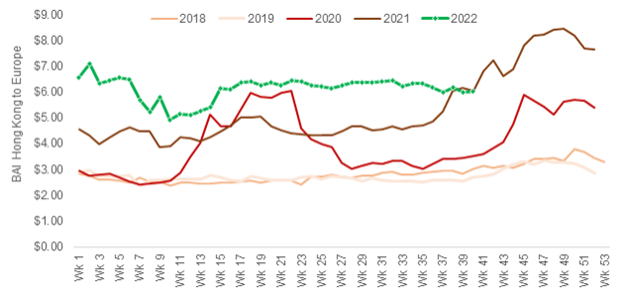

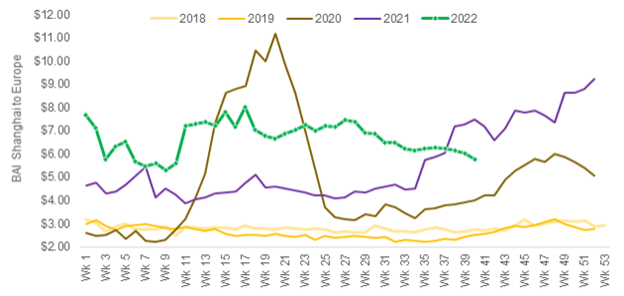

September saw a continuation of the trends of the past few months: one of softening in underlying capacity pricing in most lanes. The progression has been quite gradual on a sequential basis, as the charts below show. But against last year’s unprecedented pre-peak run-up, the year-over-year comps look decidedly weak. On Asia to North America lanes, September air freight costs per kg sank 19% y/y and 42% y/y on Hong Kong (BAI32) and Shanghai (BAI82) origins, respectively. Sequentially, they were down 4% and 9%. Against pre-pandemic levels, those lanes are still up 175% and 92%. Asia to Europe shows a similar dynamic, where Hong Kong (BAI31) and Shanghai (BAI81) were flat at 0% and down 25%, respectively on a year-over-year basis, and down 2% and 8%, respectively, on a month-over-month basis, but up 125% and 130% versus pre-Pandemic levels.

Given more inventory in the system, more fluidity in the supply chain, less residual boost from fiscal and stimulus policy, and uncertainty over the direction of the global economy, we do not believe there will be much of a peak. That said, we believe pricing is likely to remain structurally higher than pre-pandemic levels for some time, due to a number of factors.

Ultimately, we expect these trends to continue. Given more inventory in the system, more fluidity in the supply chain, less residual boost from fiscal and stimulus policy, and uncertainty over the direction of the global economy, we do not believe there will be much of a peak. That said, we believe pricing is likely to remain structurally higher than pre-pandemic levels for some time, due to a number of factors. Namely, geopolitical instability is keeping a cap on supply, even as passenger belly capacity is coming back online. Economic uncertainty is also giving some providers pause when it comes to augmenting their fleets, in our view. Finally, we believe residual volatility and still-out-of-balanced supply chains should support freight volumes as shippers look to both insure against rapid changes in the market and restore balance to their networks, even as core demand softens.

Several weeks ago, FedEx announced a significant earnings miss on the basis of global volume softening. Our take was that it was more operational than market related, given the discrepancy between the revenue miss and the earnings miss, as well as their yield resilience and the feedback from our channel checks with other major capacity providers and express operators.

A significant economic pull back could change the calculus, but we have not seen clear indication of that happening just yet. Sentiment is certainly shakybut for now it’s more fear than reality and that may help to keep a lid on capacity. Several weeks ago, FedEx announced a significant earnings miss on the basis of global volume softening. Our take was that it was more operational than market related, given the discrepancy between the revenue miss and the earnings miss, as well as their yield resilience and the feedback from our channel checks with other major capacity providers and express operators. However, the company did announce that it plans to flex its fleet down, which should be incrementally favorable for industry pricing, all else equal. Other providers may also rethink their capacity deployment strategies as the balance of the year unfolds.

The one certainty is that freight markets in general -and especially highly dynamic airfreight markets -continue to see unprecedented levels of volatility and unpredictability. Forecasts and budgeting are more challenging than ever, and safety, insurance and flexibility remain king.

Our baseline expectation is for a muted or non-existent peak, a continued normalization in freight volumes, and a continued reversion to mean on pricing into 2023. The possibility for rapid downswings in the volumes and pricing are certainly within the realm of possibility. But there is also a possibility for a rapid upswing and late season spike if inventories bleed down sufficiently and consumer demand remains more resilient than consensus currently suggests. The one certainty is that freight markets in general -and especially highly dynamic airfreight markets -continue to see unprecedented levels of volatility and unpredictability. Forecasts and budgeting are more challenging than ever, and safety, insurance and flexibility remain king.

Rates continue to cool gradually on most major global lanes in line with fundamentals, which is in stark contrast to last year’s significant run up into peak. More muted demand, weaker sentiment, greater supply chain fluidity, and higher relative inventories mean we will likely see a non-existent peak this year. However, continued economic and geopolitical uncertainty will likely favor conservatism in shipper budgeting and carrier capacity planning.

Source: BAI data, Stifel format

So where could this thesis on a widening spread in 2021 and 2022 back half rates be wrong?

Macro factors like consumer demand, energy prices, and geopolitical developments weigh heavily on the range of outcomes, and we think many shippers are securing capacity out of an abundance of caution, which also could be helping to support pricing.

So where could this thesis on a widening spread in 2021 and 2022 back half rates be wrong? Well, first, as we pointed out earlier, the “elevated inventory” story is not perfectly representative of the entire market. And current efforts by retailers to clear stock via discounting may pave the way for late-peak replenishment, in turn producing a corresponding spike in pricing later in the season. Macro factors like consumer demand, energy prices, and geopolitical developments weigh heavily on the range of outcomes, and we think many shippers are securing capacity out of an abundance of caution, which also could be helping to support pricing. Persistent congestion in the supply chain is another factor that’s helping to keep absolute rates stable: ongoing port bottlenecks; labor challenges in the U.S. and Europe in ocean, rail, and trucking; continued labor scarcity; and the potential for climate and geopolitical shocks to energy prices to name a few.

As we said last month, we believe we’ve seen peak freight volumes. Rates are likely to remain stable or grind directionally lower. The spread between current rates and year-over-year pricing should continue to moderate. The long-term trend is reversion toward mean, with the key question being how fast and to what degree. But the market is by no means predictable, especially near term. There could be sudden rate shocks, which are probably more likely to the upside (for demand reasons) than the downside (given supply constraints) at least for the duration of this year.

About Bruce Chan, Director & Senior Analyst, Global Logistics & Future Mobility Equity Research, Stifel

Bruce Chan joined Stifel in 2010 and is based out of the Miami office.

Bruce Chan can be reached at chanb@stifel.com. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors. For more information and current disclosures for the companies discussed herein, please go to the research page at www.stifel.com.

©2022 by J. Bruce Chan.