An oily boost for dry freight rates

The pros and the cons of a rising oil price on dry bulk supply and demand

The oil price has been on the rise since February 2016, and has been having an impact on the drivers for dry bulk freight.

A higher oil price will raise energy prices in general and lead to a higher extraction/mining/refining cost for most commodities which should lead to higher raw material prices.

The law of demand states that, if all other factors remain equal, the higher the price of a good, the less people will demand that good. In other words, the higher the price, the lower the quantity demanded.

A second factor on the demand side is that a higher oil price leads to higher bunker prices which makes long haul shipments relatively more expensive than short haul shipments. Thus, a higher oil price has, everything else equal, a negative impact on average sailing distances which is negative for the utilization of the fleet.

“While we still think we can forget about the freight rates seen in the hay days prior to 2011, the higher bunker price has made improvements up to the $10,000 mark much more likely.”

However, commodity prices that trends higher usually have a positive impact on stocking cycles. If the purchasers of raw materials expect the price of the raw materials to increase in future, they will buy now rather than later. Hence, rising commodity prices tend to lead to restocking which is positive for dry bulk demand. We thus find it difficult to conclude on the net effect of rising oil prices on the demand side for dry bulk.

Oil price impacts

The supply growth in shipping is usually measured as the change in carrying capacity, which is the net fleet growth calculated as new build deliveries minus scrapping. However, the effective supply growth will also depend on the speed of the fleet.

If the vessels increase their speed, they can do more voyages within a given period and the effective supply growth will exceed the underlying net fleet growth. Vice versa, if the speed is decreased the effective supply growth will be lower than the underlying growth in carrying capacity.

There are three factors impacting the optimal speed of a vessel:

• The time charter level (owner’s income)

• The bunker price (the energy cost)

• The speed/consumption curve of the individual vessel

When a vessel increases the speed it will be able to do more voyages and thus increase the gross income. However, as the speed is increased the bunker consumption and thus the bunker cost increases exponentially. The exponentiality in the speed/consumption curve will vary from vessel to vessel.

Speed evolution

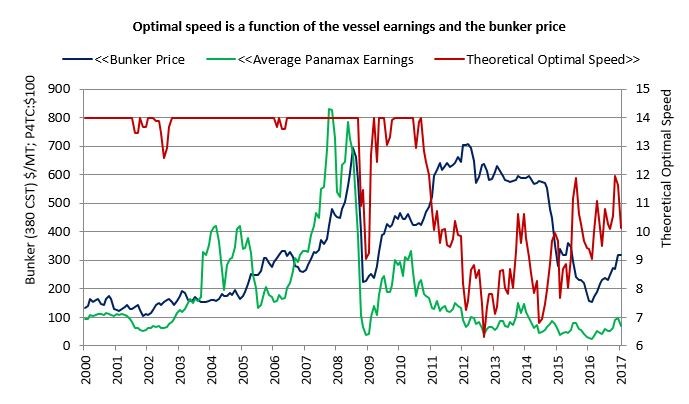

Klaveness Chartering operates around 120 vessels at any point of time ranging from supramaxes to post-panamaxes. In the calculation of optimal speed in the attached graph, we have used the average exponentially in the speed/consumption curve of the panamax and post-panamax vessels we have operated in the Baumarine Pool since 2011.

Up until 2011 full speed was the optimal speed, except for a brief period in 2002 and after the financial crisis. In 2011 vessel earnings decreased while the fuel cost (bunker cost) increased. This trend continued into 2012 and since then, except for in August 2015 and November 2016, the theoretical optimal speed has been well below the average actual speed of the fleet. Thus speed decreases has been incentivised which has reduced the effective supply growth. Due to technical limitations on the vessels the actual laden speed of the fleet has not been able to go much lower than 11.3knots.

So, if the optimal speed of the fleet increases, then there is a latent effective supply increase through speed increase of about 16-17% if the average of fleet speed increases to 13.75 knots (assuming that 80% of the voyage days are at sea). Hence, if we experience some unforeseen demand shock then the potential of speed increases will slow down the pace of improvement in freight rates.

The good news is that the higher oil and bunker price has substantially raised the infliction point for where speed increases are incentivised. If we use the Singapore bunker price from January 2016 then speed increases would have been incentivized at a level of $5,000/day and a speed of 14 knots would be the optimal speed at a low time charter level of $9,000/day.

With such a low bunker price, a fundamental improvement in rates from $5,000/day to $9,000/day would be a very slow process as we would have to churn through a supply growth of 19%. Today, the bunker price has doubled and the inflection point where the panamax fleet is incentivised to increase the speed has increased to $10,000/day, and the full speed of 14 knots is not reached before we have an average time charter level of $18,000/day.

So while we still think we can forget about the freight rates seen in the hay days prior to 2011, the higher bunker price has made improvements up to the $10,000 mark much more likely.

Peter Lindström is head of research at Torvald Klaveness. He can be contacted on +47 2252 6057 or pel@klaveness.com.