Regional variations threaten trade positivity

Trade expected to bounce back to 8% growth in 2021

By Carly Fields

Regional disparities could unsettle the relatively positive short-term outlook for trade and the economies as both recover from the Covid-19 pandemic.

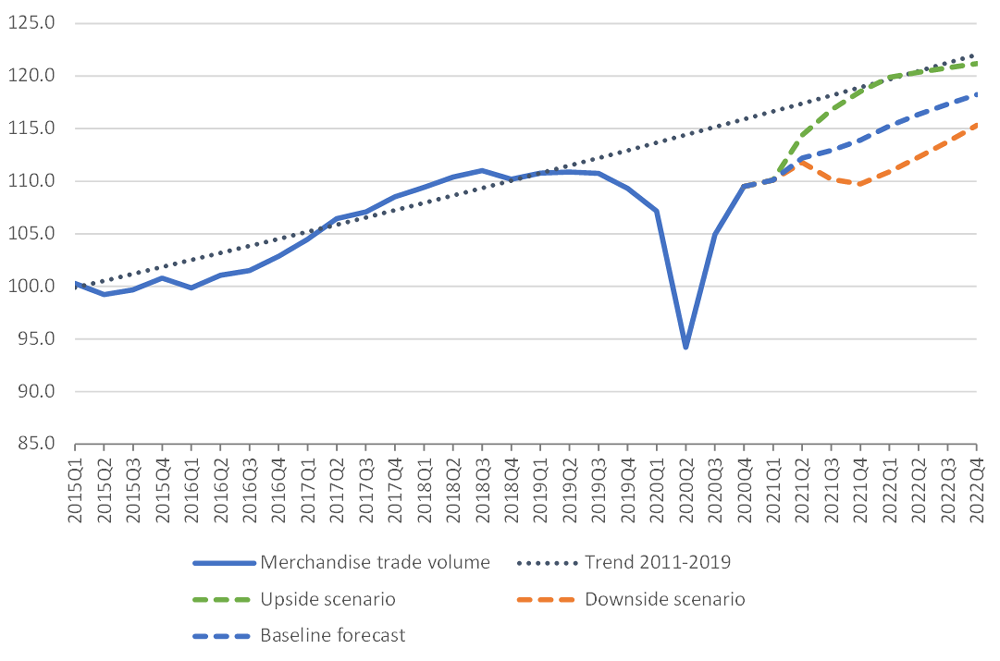

According to the latest figures from the World Trade Organization (WTO), the volume of world merchandise trade is expected to increase by 8.0% in 2021 after having fallen 5.3% in 2020. Trade growth is expected to slow to 4.0% in 2022, with the total volume of global trade remaining below the pre-pandemic trend.

The International Monetary Fund’s latest World Economic Outlook – released April 6 - projects a stronger recovery for the global economy compared with its January forecast, with growth projected to be 6 percent in 2021 (a 0.5 percentage point upgrade) and 4.4 percent in 2022 (a 0.2 percentage point upgrade), after an estimated historic contraction of -3.3 percent in 2020.

But despite the positivity, both organisations raise concerns about the regional variances in recoveries.

Trade growth is expected to slow to 4.0% in 2022, with the total volume of global trade remaining below the pre-pandemic trend

“The possibility that many countries will be left behind as we emerge from the crisis is a major concern,” said WTO director-general Ngozi Okonjo-Iweala, noting signs of divergence in trade flows across regions, despite a broad-based global economic recovery to date.

Gita Gopinath, economic counsellor and director of the research department at the International Monetary Fund (IMF), added that recoveries are “diverging dangerously” across and within countries, as economies with slower vaccine rollout, more limited policy support, and more reliance on tourism do less well.

“These divergent recovery paths are likely to create wider gaps in living standards across countries compared to pre-pandemic expectations,” she said, leading to a projected average annual loss in per capita GDP over 2020-24, relative to pre-pandemic forecasts, of 5.7 percent in low-income countries and 4.7 percent in emerging markets.

In 2021, import demand for traded goods will be driven by North America (11.4%) thanks to large fiscal injections in the US, which should also stimulate other economies through the trade channel

Asia and US promise

In 2021, import demand for traded goods will be driven by North America (11.4%) thanks to large fiscal injections in the US, which should also stimulate other economies through the trade channel. Europe and South America will both see import growth of around 8%, while other regions will register smaller increases.

The WTO anticipates that much of this year’s global import demand will be met by Asia, where exports are expected to grow by 8.4% in 2021. European exports will increase nearly as much (8.3%), while shipments from North America will see a smaller rise (7.7%).

Given the regional variations, Okonjo-Iweala warned against a rise in protectionism describing it as “damaging not just to global economic growth but to vaccine production as well”. "The strong rebound in global trade since the middle of last year has helped soften the blow of the pandemic for people, businesses, and economies," she added.

The WTO cites Covid-19 as the greatest threat to the outlook for trade, as new waves of infection could easily undermine any anticipated recovery. Short-term risks to the WTO’s positive 2021 outlook are centred on pandemic-related factors. These include insufficient production and distribution of vaccines, or the emergence of new, vaccine-resistant strains of Covid-19.

Outlining two alternative scenarios for trade, the WTO discusses an upside scenario where vaccine production and dissemination accelerates, allowing containment measures to be relaxed sooner, “which could raise trade growth up to 2.5 percentage points above the baseline forecast in 2021 — returning trade to the pre-pandemic trend”, Okonjo‑Iweala said. However, on the other hand, if supply shortages continue, or if vaccine-resistant strains of the virus emerge, “trade growth could end up 2 percentage points below the baseline forecast”.

If supply shortages continue, or if vaccine-resistant strains of the virus emerge, “trade growth could end up 2 percentage points below the baseline forecast”

Better than expected

Looking back, the 5.3% decline in merchandise trade for the whole of 2020 was more positive than expected in the previous WTO forecast from October 2020. The improvement is explained by the arrival of Covid-19 vaccines, which contributed to improved business and consumer confidence. But as with the 2021 outlook figures, there were sizable regional variations. While most regions recorded large declines in both exports and imports, Asia did not with export volumes up 0.3% and import volumes down a modest 1.3%. The WTO notes that regions rich in natural resources saw the largest declines in imports in 2020, including Africa (-8.8%), South America (‑9.3%) and the Middle East (-11.3%).

US stimulus is expected to pull up economic growth for advanced economies in 2021 and 2022. The IMF forecasts a 6.4% growth in US GDP this year making it the only large economy projected to surpass the level of GDP it was forecast to have in 2022 in the absence of this pandemic.

Other advanced economies, including the euro area, will also rebound this year but at a slower pace. Among emerging markets and developing economies, China is projected to grow this year at 8.4 percent, said the IMF. “While China’s economy had already returned to pre-pandemic GDP in 2020, many other countries are not expected to do so until 2023,” it notes.