Hard reining in of trade growth

A 5.8 percentage point drop from 2021 to 2022 sets the downward tone for 2023

By Carly Fields

Global trade growth looks set to plummet from 10.1% in 2021 to 4.3% in 2022, with further slippage to 2.5% in 2023, according to the latest International Monetary Fund’s World Economic Outlook (WEO).

While this is noted as higher growth than in pre-pandemic 2019, it is still well below the historical average of 4.6% for 2000-21 and 5.4% for 1970-2021.

The forecast declines reflect drops in global output growth, said the IMF, compounded by supply chain constraints and the dollar’s appreciation in 2022. The dollar had increased by about 13 percent in nominal effective terms as of September compared with the 2021 average, which will have impacted the growth of predominantly dollar-denominated trade.

The WEO also notes a widening of global current account balances. While “not necessarily a negative development”, excessive global imbalances can fuel trade tensions and protectionist measures or increase the risk of disruptive currency and capital flow movements, said the IMF.

China is specifically highlighted for its role in declining trade growth. “The frequent lockdowns under its zero Covid policy have taken a toll on the economy, especially in the second quarter of 2022. Furthermore, the property sector, representing about one-fifth of economic activity in China, is rapidly weakening.

“Given the size of China’s economy and its importance for global supply chains, this will weigh heavily on global trade and activity.”

That said, while there are limited upsides to the IMF’s downbeat forecast, prospects may improve if “other factors continue to improve even as challenges in China remain”.

On the downside

The downside risks are more acute. First, the WEO cites the risk of monetary policy miscalculating the right stance to reduce inflation. Second, policy paths in the largest economies could continue to diverge, leading to further US dollar appreciation and cross-border tensions. Third, more energy and food price shocks might cause inflation to persist for longer. Fourth, global tightening in financing conditions could trigger widespread emerging market debt distress. Fifth, halting gas supplies by Russia could depress output in Europe. Sixth, a resurgence of Covid-19 or new global health scares might further stunt growth. Seven, a worsening of China’s property sector crisis could spill over to the domestic banking sector and weigh heavily on the country’s growth, with negative cross-border effects. Lastly, geopolitical fragmentation could impede trade and capital flows, further hindering climate policy co-operation.

“The balance of risks is tilted firmly to the downside, with about a 25% chance of one-year-ahead global growth falling below 2.0% - in the 10th percentile of global growth outturns since 1970,” said the report.

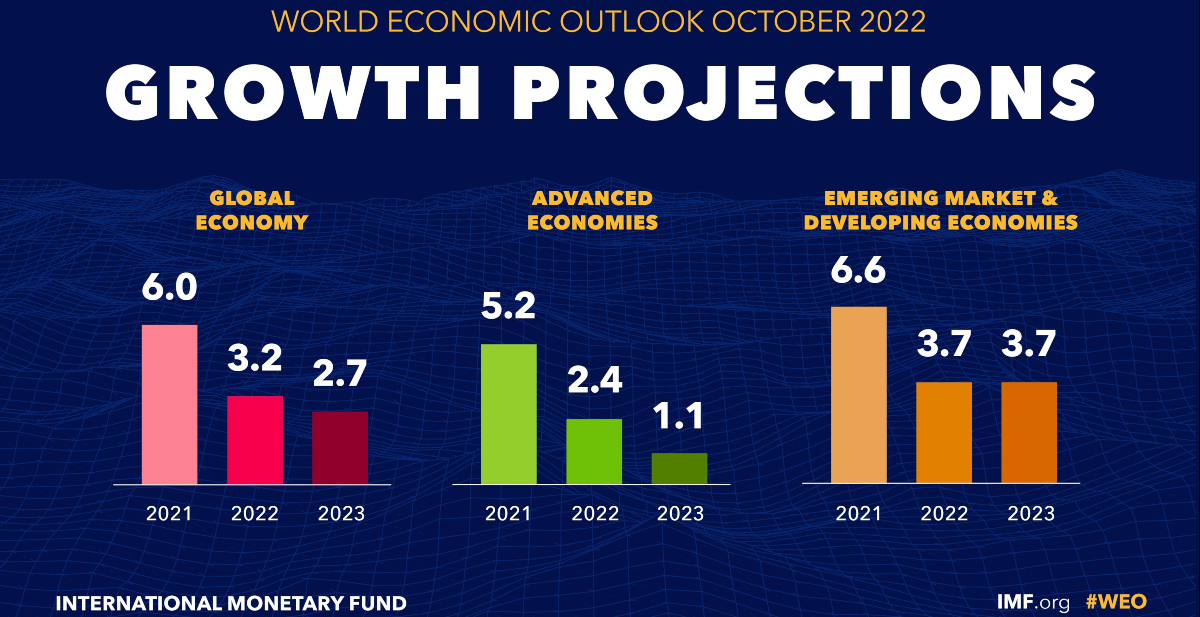

In more general terms, the IMF predicts a slowdown in global economic growth from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023, well below the average: global economic growth averaged 3.6% during 2000-21 and between 1970-2021.

Pierre-Olivier Gourinchas, economic counsellor and the director of research of the IMF, said: “The 2023 slowdown will be broad-based, with countries accounting for about one-third of the global economy poised to contract this year or next. The three largest economies, the United States, China, and the euro area will continue to stall. Overall, this year’s shocks will re-open economic wounds that were only partially healed post-pandemic.

In short, the worst is yet to come and, for many people, 2023 will feel like a recession.”

Weak economies all-round

A total of 143 economies - accounting for 92% of world GDP - are facing weaker economies in 2023. In fact, the IMF noted that the forecast for 2023 is the weakest since the 2.5% growth rate seen during the global slowdown of 2001, with the exception of those seen during the global financial and Covid-19 crises.

The negative revisions for China, the euro area, and the US reflect tightening global financial conditions, expectations of steeper interest rate rise by major central banks to fight inflation, a sharper slowdown in China due to extended lockdowns and the worsening property market crisis, and spill over effects from the war in Ukraine.

The IMF noted that while a decline in global GDP or in global GDP per capita is not currently in its the baseline forecast, a contraction in real GDP lasting for at least two consecutive quarters - which the IMF notes some economists refer to as a “technical recession” - is expected at some point during 2022-23 in about 43% of economies with quarterly data forecasts - 31 out of 72 economies. That accounts for more than one-third of world GDP.

Additionally, projections for global growth on a fourth-quarter-over-fourth-quarter basis point to a “significant weakening”, to only 1.7% in 2022 and to 2.7% in 2023, with negative revisions more pronounced for advanced economies than those for emerging market and developing economies.

“Overall, the outlook is one of increasing growth divergence between advanced and emerging market and developing economies,” concluded the IMF.