Tanker supply “falling off a cliff”

Full yards and high prices deter demanding ordering spree

By Carly Fields

Tanker supply is set to “fall off a cliff” in 2023, resulting in what a leading shipping analyst describes as a “tremendous” fleet.

Dag Kilen, head of research at Fearnleys AS, and a presenter at the Baltic Exchange Tanker Market Insights Webinar, part of International Energy Week, said that the tanker orderbook for 2023 and 2024 is very low. This runs counter to the orderbooks for other shipping segments which have orders running into 2025. “That's not really the case for tankers, so once we are through this year, it really falls off the cliff when it comes to supply.”

Kilen said that tanker deliveries in 2023-24 will average about 7.3 million deadweight per annum against just over 28 million deadweight delivered per year over the last five years. Also, the current tanker orderbook is just 7% of the existing fleet. He added that the sector is moving into a period where the tankers ordered during the China boom years from the early-to-mid 2000s are now phase-out candidates. “We already have 11% of the fleet 20 years or older and if you move to 15+ years then all of a sudden a third of a fleet is now coming up on the radar for phase out. At the same time, we don't have much of an orderbook.”

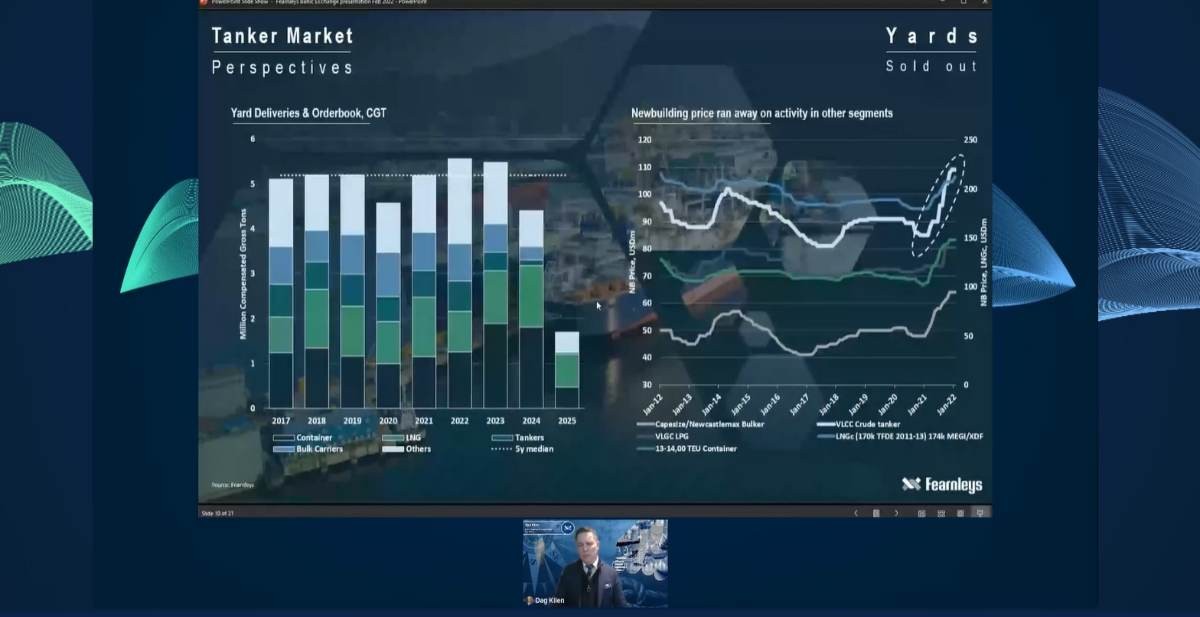

In a normal cycle this situation would have been easy to address, Kilen said. History tells us that once the tanker market starts to recover, owners “lose their head” and order a flurry of vessels. However, there are some stark differences this time around. First is that Chinese and Korean shipyards are full for 2023 and 2024. “If you're looking to order bigger vessels, we are mainly looking at 2025. So, it would be 2025 at the earliest that the owners could start disrupting again by ordering too many vessels.”

If you're looking to order bigger vessels, we are mainly looking at 2025. So, it would be 2025 at the earliest that the owners could start disrupting again by ordering too many vessels

Price rally

There is another catch: newbuilding prices have been running away from tanker owners. “Despite weak earnings on the tanker side, newbuilding prices and secondhand prices have been much higher, driven by activity across other segments. Yards have needed to hike prices and with the solid backlog they have all the way into 2025 they have also been able to hike prices.”

Then there are also emission goals to be factored in, for example the European Union’s Fit for 55 package and the IMO’s greenhouse gas strategy. “Owners now need to navigate all this and know exactly what to do and how to be compliant down the road. You don't want to take the risk of contracting something today that is a semi- or fully-stranded asset by the end of the life of the vessel.”

This all adds up to the lowest order book since the 1970s and 1980s, Fearnleys calculates. “Fleet supply looks tremendous,” said Kilen. “The only question here is are we going to have a short-lived spike or a more orderly and longer upcycle? Both have the potential of starting this year.”

On the demand side, an analysis of VLCC cargo liftings out of the main trades confirms that the market is not yet fully back to pre-Covid levels – despite an improvement in the number of cargo listings through the second half of 2021. And even though oil demand is improving, production is not, and this has proved to be a drag on tanker volumes.

“Looking in more detail, we can see that in December 2021 versus December 2019, it wasn't too bad. But if we take overall 2020 volumes out of the Middle East, these were 16% below the 2019 level. They dropped further - almost 5% - from 2020 into 2021. This is of course something that has been a negative through 2021 and into the beginning of this year, both on the tanker market and on earnings,” said Kilen.

The long haul routes have really felt the pain. While volumes held up in 2020, they slumped in 2021, dropping about 12% compared with 2020. “And this happened as the oil market in the Atlantic basin was relatively tighter compared to the East market where US producers had more discipline on their comeback.”

The rally in oil prices forced bunker prices to rise - which is “never a positive thing for tankers”, Kilen said - putting downward pressure on tanker earnings.

Fleet slowdown

Oil prices have also played their part in the mixed market recovery. The rally in oil prices forced bunker prices to rise - which is “never a positive thing for tankers”, Kilen said - putting downward pressure on tanker earnings. A knock-on effect has been the slowdown of the tanker fleet. Fearnleys data revealed that the average speed for ballasting VLCCs was 11.2 knots towards the end of February. “That should be closer to 12.5 knots before we can expect to see the market rebalance.”

This has also led to an imbalance in tanker availability with a plentiful supply in the East, but less so in the Atlantic basin, because it has been too expensive to ballast back to the Atlantic basin. There is also an usually high number of vessels east of Suez compared with West of Suez. “This means that once you start to see a recovery on the tanker market, I would anticipate that to be triggered by something in the Atlantic basin,” Kilen concluded.