BAI Index: Mean Reversion Underway

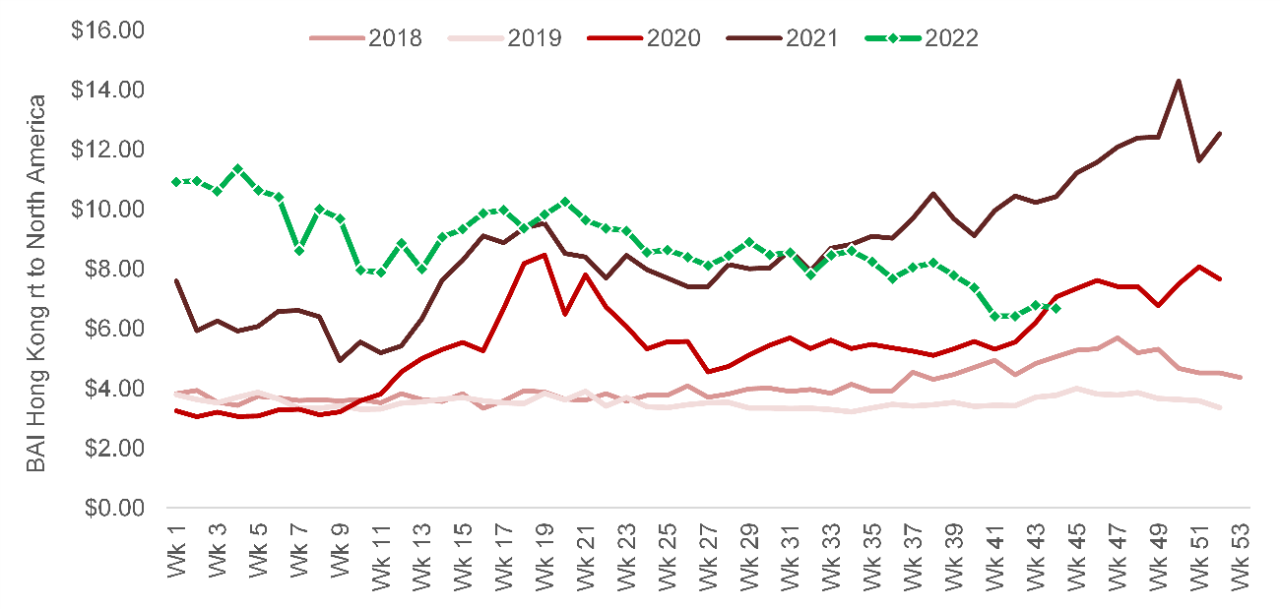

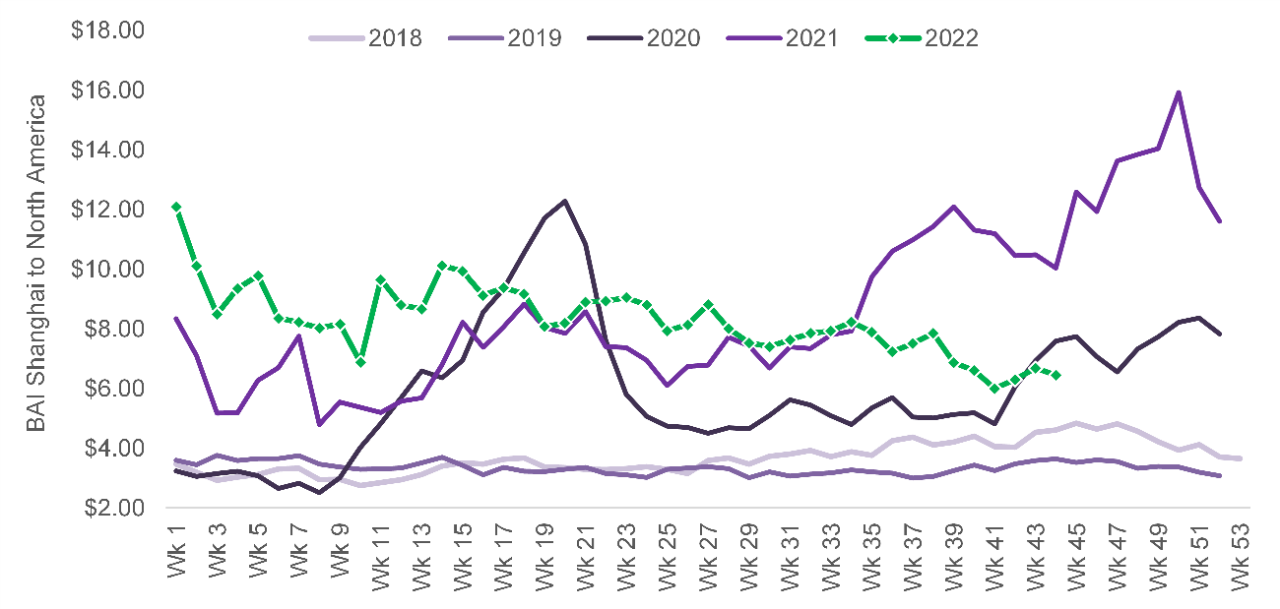

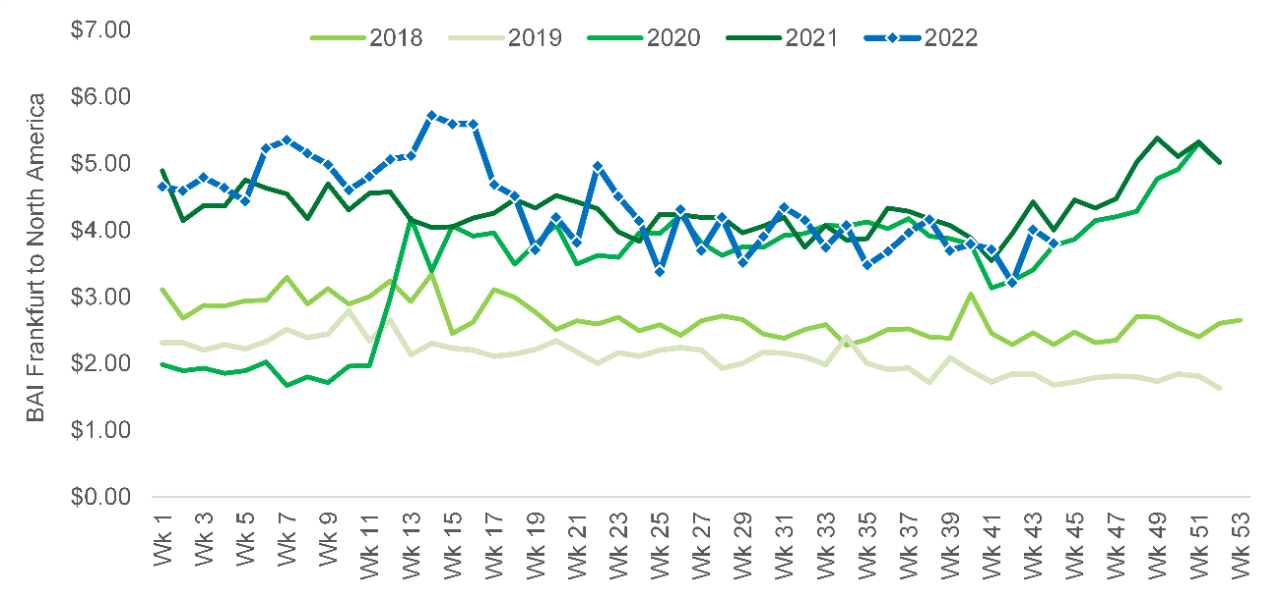

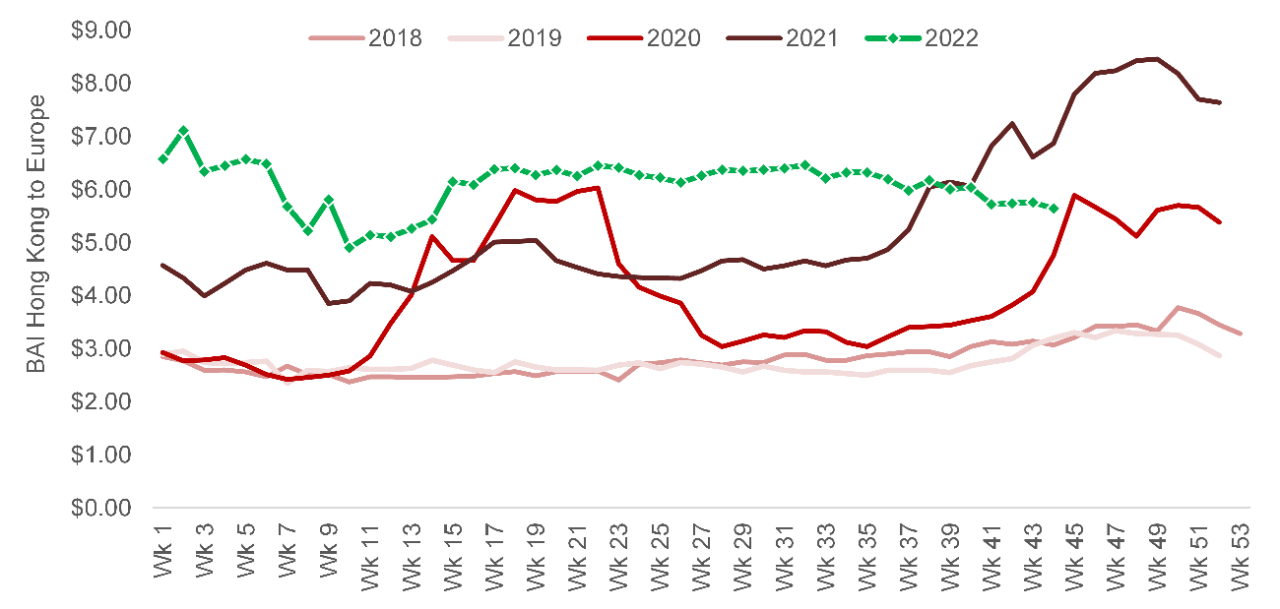

October air cargo yields saw continued sequential deceleration from mid-year levels - and perhaps even faster than we expected. Shanghai to North America (BAI82) declined 13% from September, while Hong Kong to North America (BAI32) slid 15% relative to the same period. Europe-destined lanes experienced similar but less pronounced trends, with Shanghai origin (BAI81) down 7.5% since September, and Hong Kong origin (BAI31) down 5%.

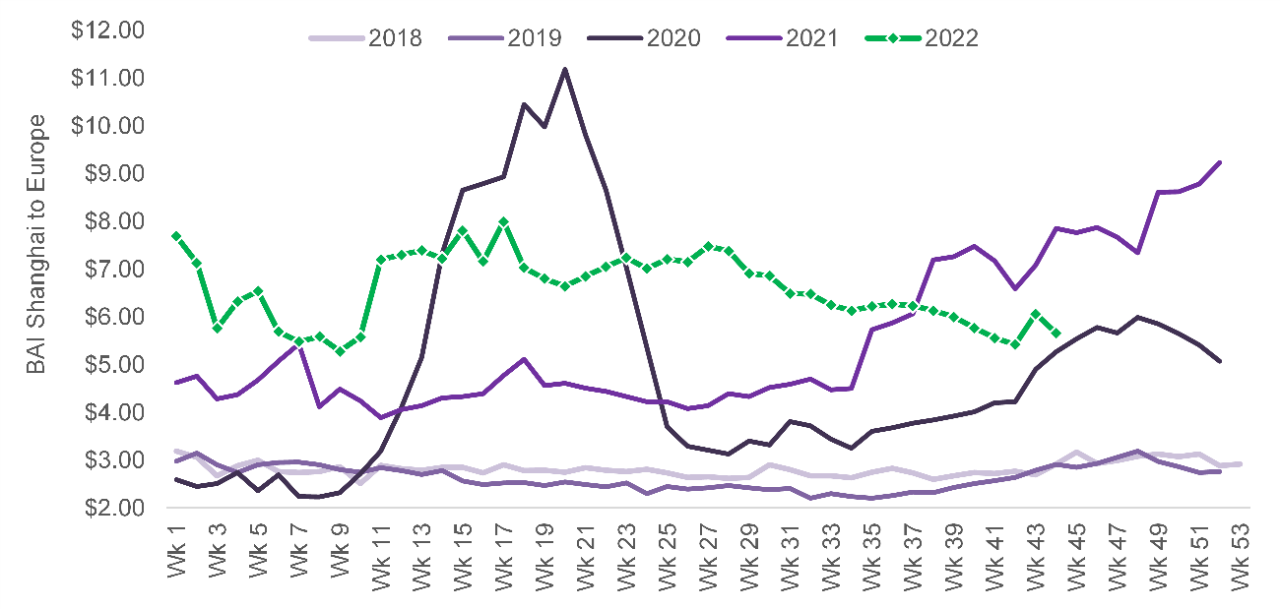

At the outset of 3Q22, rates per kilogram crossed below 2021 levels, given an exceptionally strong 2021 peak season comparison and a discernable lack of peak this year. As we move deeper into the fourth quarter, prices are softening still - crossing beneath 2020 peak season levels in some cases.

At the outset of 3Q22, rates per kilogram crossed below 2021 levels, given an exceptionally strong 2021 peak season comparison and a discernable lack of peak this year. As we move deeper into the fourth quarter, prices are softening still - crossing beneath 2020 peak season levels in some cases. On a year-over-year basis, North America-destined lanes were down 41% and 32% from Shanghai (BAI82) and Hong Kong (BAI32), although they are still 1.8x and 1.6x the pre-pandemic average. One Europe-destined lanes, rates were lower by 21% and 14% y/y from Shanghai (BAI81) and Hong Kong (BAI31), respectively, though still 2.1x and 1.9x above pre-pandemic.

We attribute the deceleration in rates to three, primary factors. First, as mentioned, there has been a conspicuous lack of peak season this year. We believe that is due in large part to a material pull forward in ordering as shippers - especially large, consumer-oriented shippers - sought to get ahead of supply chain backlogs and avoid the stock-outs of previous years. This behavior seems evident in the rapid buildup in inventories earlier this year.

Second, we attribute the rates to a softening in core demand. Whether due to the waning impact of government stimulus, the effects of significant global inflationary pressure, trepidation over the future potential recession, or some combination of these and other factors, we have seen broad indications of gradual, but measurable demand slowdown in global freight volumes. This easing is putting pressure on the demand side of global air capacity, in our view.

On the other side of the capacity equation, we are seeing the effects of increased supply. The increase is coming from multiple vectors, including lower deck belly space from the gradual return of long haul passenger flights. The deflationary impact here may be exacerbated by its tendency to be priced on a contribution margin basis - supplemental to passenger ticket prices. Trade down is not limited within airfreight service levels; clearing port congestion and more fluid overall supply chains are reducing the need for highly-elastic expedited modes and allowing shippers to convert back to cheaper ocean or overland options where practical and available.

If (as) fundamental macro trends continue to soften, we do expect further mean reversion in pricing. And while rates have already come down meaningfully, they’re certainly not at recessionary levels. They haven’t even returned to pre-pandemic normal levels. So, there’s more potential downside.

Fuel has also been a factor in pricing, but its effects have been volatile and inconsistent. Average U.S. Gulf Coast Kerosene in October, for example, is 7% lower than the 2Q22 average, but 14% higher than last month, and 62% higher than October 2021, implying that core sequential and year-over-year pricing declines may be even greater.

If (as) fundamental macro trends continue to soften, we do expect further mean reversion in pricing. And while rates have already come down meaningfully, they’re certainly not at recessionary levels. They haven’t even returned to pre-pandemic normal levels. So, there’s more potential downside. But the path forward is not certain and it probably won’t be smooth. So shippers that still prioritize supply-chain service and latency may be reluctant to let go of current practices, and that may help support contract rates relative to spot. Fuel will likely continue to vacillate, especially with mounting geopolitical tensions in Europe and the Middle East. Going back to the inventory discussion from this piece and prior installments, if elevated inventories and a muted peak are mostly a result of early (over) ordering, and if certain retail inventory clearing events in consumer end markets had a substantial enough effect, we could see a late season surge in volume. While these events don’t necessarily factor into our base case, we mention them to underscore some of the potential known unknowns that could affect rate levels in subsequent months.

Exhibit 1: Rates have declined sequentially from mid-year, and in some cases, fallen below not just peaky 2021 levels, but also 2020 levels. Still, they remain at multiples of pre-pandemic averages, so further normalization is likely, but it could be a bumpy path forward, in our view.

Source for all charts: BAI data, Stifel format

About Bruce Chan, Director & Senior Analyst, Global Logistics & Future Mobility Equity Research, Stifel

Bruce Chan joined Stifel in 2010 and is based out of the Miami office.

Bruce Chan can be reached at chanb@stifel.com. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors. For more information and current disclosures for the companies discussed herein, please go to the research page at www.stifel.com.

©2022 by J. Bruce Chan.