BAI Index: Rates Aren’t Falling, But They’re Also Not Going Up Yet As China Reopens; Here Are Some Thoughts on Why

As China emerges slowly from widespread lockdown, June airfreight rates were mostly lower in June versus May 2022. Rates to North America were down from May to June by 10% and 2% from Hong Kong (BAI32) and Shanghai (BAI82), respectively. They were down 1.4% from May to June on Hong Kong to Europe (BAI31). Only on the Shanghai to Europe route (BAI81) did they increase -by a little over 4%. For perspective, though, all of these rates are still higher -in some cases meaningfully so -against 2021’s elevated levels.

On the Asia-to-Europe side, rates in June from Hong Kong and from Shanghai were still approximately 44% and 70% higher than the same period in 2021. Rates touching North American were more muted, but still up 11% and 25% y/y from Hong Kong and Shanghai, respectively.

On the Asia-to-Europe side, rates in June from Hong Kong and from Shanghai were still approximately 44% and 70% higher than the same period in 2021. Rates touching North American were more muted, but still up 11% and 25% y/y from Hong Kong and Shanghai, respectively.

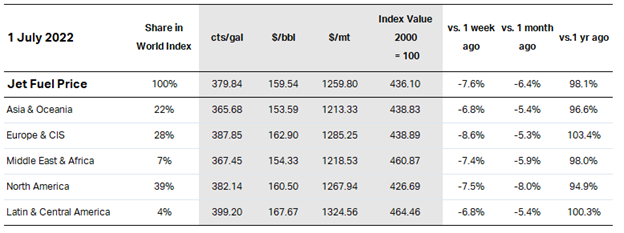

While we had expected rates to climb through the month as restrictions eased, particularly on China-origin flights, that result did not clearly play out. There are four possible explanations, in our view, none of them being mutually exclusive. First, as shown in Exhibit 1 below, fuel prices tapered steadily during the month, tempering increases on base rates.

Exhibit 1: Fuel prices have moderating somewhat, removing upward pressure on fully-baked air freight rates.

Source: IATA

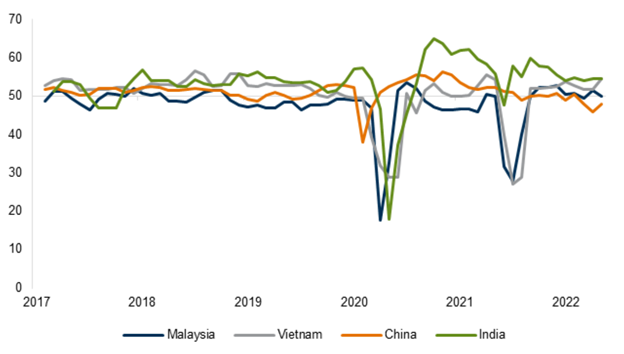

Second, the third quarter is typically the second-slowest air freight shipping season, and we are currently entering the normal late-summer lull before the onset of the holiday peak. So there is a potential that seasonal demand patterns are helping to keep pricing stable. The third possible explanation is that the post-shutdown manufacturing ramp in China has been and will be more gradual than we expected. Manufacturing PMI in China recovered in May, but was still below trend and in contraction territory, as shown below in Exhibit 2. We do not have data yet for the month of June. Weekly sequential volumes out of Asia shows a more consistent upward pressure on rates as of 4 July data (which reflects the end of June, as there is a slight lag in collection), though we are reluctant to extrapolate too much from one weekly move.

Exhibit 2: China PMI recovered in May, but is still in negative territory; post-lockdown build may take more time

Source: IHS Markit and Stifel Research

Are we seeing signs that the recessionary boogey man has arrived? Airfreight volumes and airfreight rates are likely a leading indicator, in our view, but we don’t have clear evidence to support that thesis

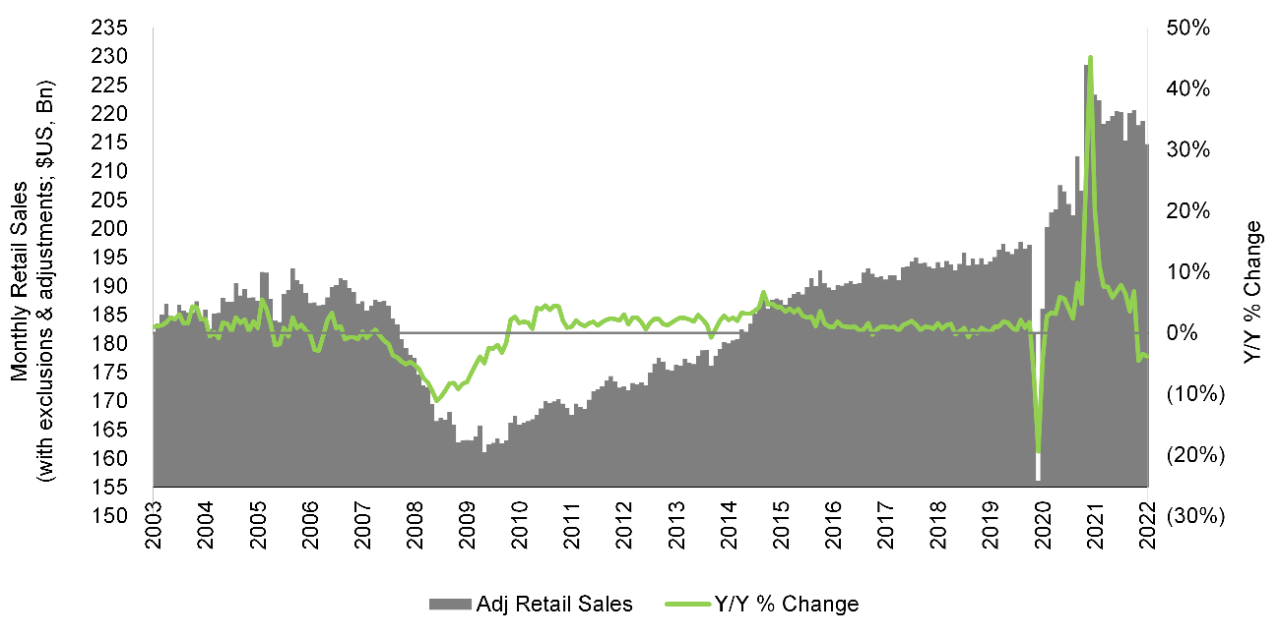

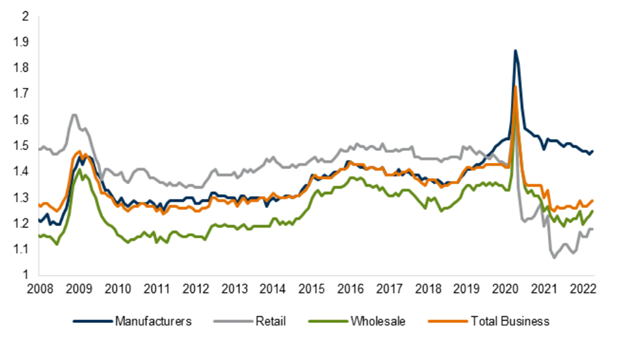

Finally, there’s the possibility that demand is starting to moderate on a longer-term basis. Are we seeing signs that the recessionary boogey man has arrived? Airfreight volumes and airfreight rates are likely a leading indicator, in our view, but we don’t have clear evidence to support that thesis. Annualized U.S. GDP contracted 1.6% in 1Q22, for example, but unemployment and absolute consumer spending figures have been more resilient, and U.S. inventory to sales ratios remain near all-time lows.

As we’ve said in previous installments, we don’t and cannot discount the possibility of the last scenario. And, while we do expect a broader slowdown at some point in 2023, we believe that what is currently impacting rates is shorter-term in nature.

Exhibit 3: Absolute U.S. Real Retail Sales remain surprisingly resilient

Source: U.S. Census Bureau, Bureau of Labor Statistics; Stifel Research

Note: U.S. Retail Sales excluding gas, adjusted for CPI & Population change

Exhibit 4: And Inventory to Sales Ratios remain near all-time lows

Source: FRED and Stifel Research

About Bruce Chan, Director & Senior Analyst, Global Logistics & Future Mobility Equity Research, Stifel

Bruce Chan joined Stifel in 2010 and is based out of the Miami office.

Bruce Chan can be reached at chanb@stifel.com. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors. For more information and current disclosures for the companies discussed herein, please go to the research page at www.stifel.com.

©2021 by J. Bruce Chan.