BAI Index: Russian Invasion of Ukraine: Inflationary to Air Cargo Pricing; Increases Risk of Long Term Demand Shock

We find it difficult to put aside the human toll of the conflict in Ukraine and focus on the implications for air cargo, but that doesn’t mean there won’t be any. As we come up on the two-year anniversary of Covid-19, the industry is still reeling from the capacity and pricing ramifications of the pandemic. As a result, subsequent supply shocks will be felt more acutely, as there is less of a capacity buffer to absorb them. Near term, direct price increases will result from higher fuel costs, and the potential for surcharges if carriers feel the need to offset longer routes and lower payloads. Indirectly, supply has come out of the system, which will put pressure on market pricing - particularly on the Asia-Europe lane. Longer term, the question is one of demand, as higher energy costs and the economic reverberations of sanctions may dampen demand for high-elasticity consumer goods. However, there is a lot that can happen in the meantime that will affect the outlook on that front.

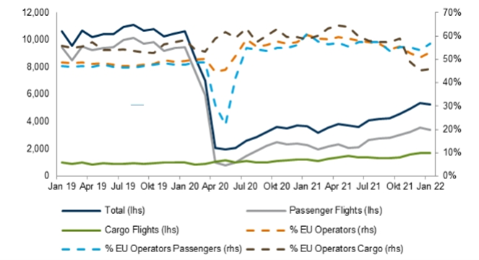

About 50% of Asia-Europe flights are operated by European airlines, making them directly subject to diversion around Russian air space, increasing route length and effectively decreasing supply as more fuel is used and payloads have to be limited to accommodate longer, diverted transits.

Near term, we think the impact of war in Ukraine is reductive to supply and inflationary to pricing. On the supply side, the immediate closure of air space above Ukraine, Russia, and other countries means disruption to certain existing flight paths, adding time, distance, or additional stops. About 50% of Asia-Europe flights are operated by European airlines, making them directly subject to diversion around Russian air space, increasing route length and effectively decreasing supply as more fuel is used and payloads have to be limited to accommodate longer, diverted transits. Russian airlines, specifically, have been banned from EU airspace - including Aeroflot and AirBridgeCargo. The latter is a top-20 global provider, with 18 widebody freighters, reducing already tight capacity on Asia-Europe lanes.

Exhibit 1: Number of Flights from Europe into Asia

Source: DIIO and Stifel Research

Furthermore, Approximately 75% of Russia’s domestic fleet consists of western-built aircraft, and current sanctions and corporate actions mean that manufacturers like Boeing and Airbus will no longer supply spare parts. Of the aforementioned 75% of western-built planes, almost 80% are leased. And current sanctions also require termination of those leases. Whether those terminations can actually be effected, and if so, whether equipment gets deployed on alternate lanes is a derivative consideration that is difficult to make at this point.

Longer term, we believe the question of impact shifts more toward demand. As the price of energy increases - including natural gas for home heating, gasoline for consumer use and diesel and other petroleum distillates for industrial use - costs will rise on top of existing inflationary pressures, which will dampen disposable discretionary income and thus weigh on the consumption of goods. Again, the extent to which this occurs will depend on geopolitical factors that are beyond our scope of expertise - Germany’s willingness to keep Nord Stream 2 offline, for example.

Less tangibly, there is potential for significant operational disruption as a result of collateral cyber warfare. We have already seen Expeditors International fall victim to such attacks and we have received reports of significant disruptions to their service. While that particular disruption may not get reflected in underlying air cargo capacity pricing, it will be felt by those who consume air cargo and air freight forwarding services.

Yet despite all of the foregoing, we haven't seen clear evidence of these events in our pricing data. We do expect to see more substantial increases in subsequent weeks as the market has time to absorb recent events, and we expect most of the effect on Europe-based lanes

Yet despite all of the foregoing, we haven't seen clear evidence of these events in our pricing data. We do expect to see more substantial increases in subsequent weeks as the market has time to absorb recent events, and we expect most of the effect on Europe-based lanes. But so far, on Asia-to-North America lanes, rates cooled sequentially this week out of Hong Kong (BAI32) by almost 18% and 16% out of Shanghai Pudong (BAI82). They were still 43% and 28% higher, respectively, than they were in an already-tight period this week in 2021. On the Asia-to-Europe side, rates this week fell 16% sequentially out of Hong Kong (BAI31) and rose 6% out of Shanghai (BAI81). Respectively, they were up around 26% and 32% each versus this week last year. Frankfurt-to-North America rates fell 8% sequentially over last week, and were up a modest 7% over this week last year.

The elephant in the room - and where we could see a quick fix to disruption is a significant deterioration in demand. While we do not anticipate a significant shock in the near term, the added pressure of higher energy prices on already-historic inflation may make such a deterioration more likely.

As far as the global supply chain, we see many of the same broad, fundamental supply issues in 2022 as we experienced during 2021, meaning no quick fix to the present quagmire. Recent geopolitical events should only serve to further disrupt an already constricted global air cargo capacity. The elephant in the room - and where we could see a quick fix to disruption is a significant deterioration in demand. While we do not anticipate a significant shock in the near term, the added pressure of higher energy prices on already-historic inflation may make such a deterioration more likely.

In short, we think recent events make it likely that prices go higher in the near term. And, while it is not our base case, we think recent events also make it more likely that there could be material, longer term, demand destruction, which would push prices sharply lower. Like many others, and for many reasons, we hope and pray for a quick and peaceful resolution to current events.

About Bruce Chan, Director & Senior Analyst, Global Logistics & Future Mobility Equity Research, Stifel

Bruce Chan joined Stifel in 2010 and is based out of the Miami office.

Bruce Chan can be reached at chanb@stifel.com. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors. For more information and current disclosures for the companies discussed herein, please go to the research page at www.stifel.com.

©2021 by J. Bruce Chan.