BAI Index January 2026: Air freight rates reach December peak then fall sharply to end a tumultuous year

2025 was certainly an unpredictable, volatile and at times chaotic year for global trade. Nevertheless, global air freight rates largely followed the traditional pattern – rising to a seasonal peak in the runup to Thanksgiving in the US and Christmas in Europe, then falling sharply as volumes dropped over the New Year.

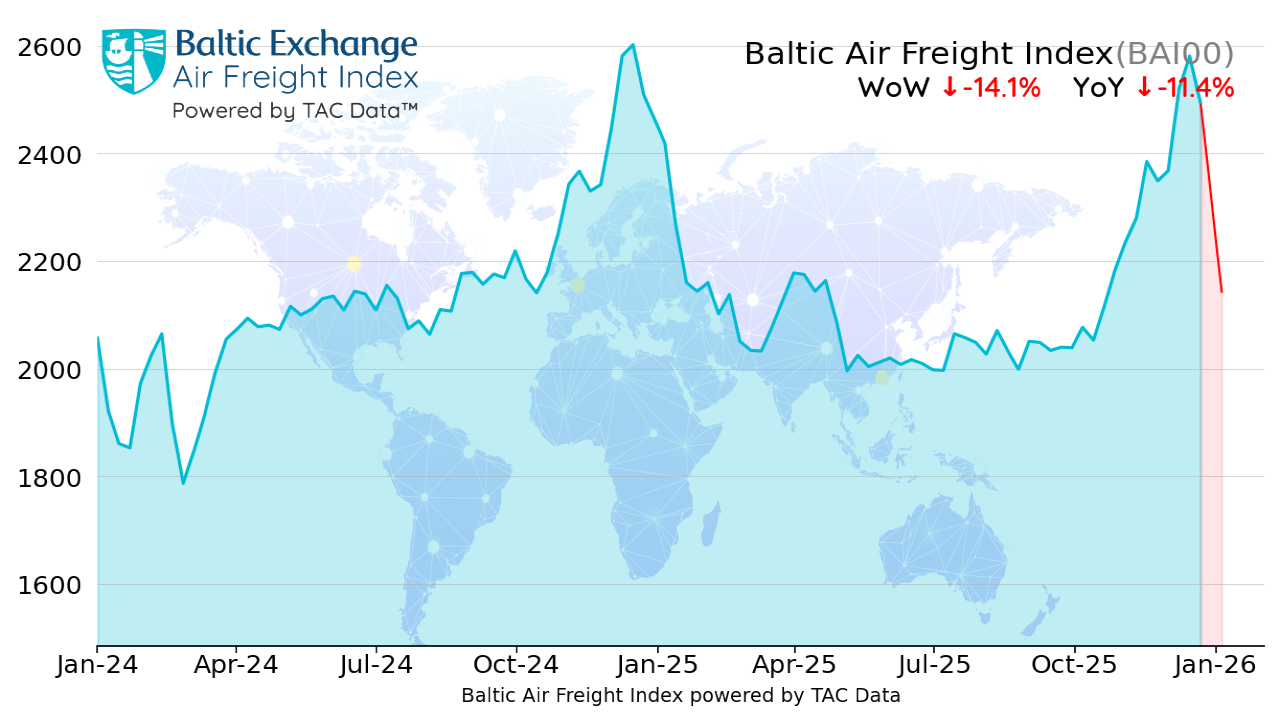

The global Baltic Air Freight Index (BAI00) calculated by TAC Data continued rising steadily through the first half of December before falling steeply in the final week after Christmas, ending the four weeks to 5 January lower by -15.0%.

That put the global index back below where it was the year before at -11.4% year-on-year (YoY), although almost entirely due to a steeper than usual fall of -14.0% over the final week.

Given the scale of geopolitical tensions and disruption due to rapid and unpredictable changes in tariffs and trade patterns, it is remarkable how overall activity and rates diverged so little from previous years. As we noted last month, although direct China-US trade volumes fell in 2025, that was more than offset by higher China-Europe, intra-Asia and other volumes elsewhere, such as into the Middle East and Africa.

Given the scale of geopolitical tensions and disruption due to rapid and unpredictable changes in tariffs and trade patterns, it is remarkable how overall activity and rates diverged so little from previous years. As we noted last month, although direct China-US trade volumes fell in 2025, that was more than offset by higher China-Europe, intra-Asia and other volumes elsewhere, such as into the Middle East and Africa.

These changes showcased the incredible flexibility of the air cargo market to respond rapidly and switch capacity quickly to wherever it might be needed.

As the year unfolded, the industry was able to respond opportunistically as circumstances changed. Following the re-election of Donald Trump as President in the US, for instance, air cargo activity was initially boosted by shippers ‘front-loading ahead of Trump’s ‘Liberation Day’ announcement of severe higher tariffs against US trade partners.

Then, after markets initially plummeted and cargo volumes fell back, rates got a further bounce when Trump backed down, with shippers rushing to re-stock shelves when US tariff levels were lowered, at least short term.

Meanwhile, supply chains continued to shuffle, with many manufacturers moving towards ‘China plus one’ production and delivery systems, boosting intra-Asia trade in particular.

The focus of e-commerce sales also switched away from the US to Europe, the Middle East and Africa, and Asian markets, further boosting intra-Asia trade.

China’s success in adjusting to the challenge of Trump’s trade war was highlighted by figures suggesting its annual trade surplus weighed in at over $1 trillion for the first time.

With overall cargo volumes still rising according to IATA numbers, air freight rates were also underpinned by constraints on capacity. Both of the main manufacturers, Airbus and Boeing, remained way behind on scheduled deliveries, with a continuing shortage of feedstock for conversions, particularly of large widebody freighters.

With overall cargo volumes still rising according to IATA numbers, air freight rates were also underpinned by constraints on capacity. Both of the main manufacturers, Airbus and Boeing, remained way behind on scheduled deliveries, with a continuing shortage of feedstock for conversions, particularly of large widebody freighters.

This shortage of capacity was further exacerbated in late 2025 by the fatal crash of a UPS freighter, resulting in the whole ageing fleet of about 60 active MD-11s getting grounded for safety checks, sidelining about 10% of widebody capacity from the market.

With jet fuel prices also a little lower, by an average of -4% over the year according to the latest Platts data, 2025 should have proved another profitable year for most carriers.

All of that said, spot rates fell sharply in December after peak season reached its climax and then ended abruptly. BAI Spot rates from Hong Kong to the US East Coast, which had begun the month on 1 December at HK$54.04 per kilo, had dropped to HK$43.39 by 2 January. HK to the US West Coast also dropped precipitously from HK$51.32 per kilo to HK$41.69 over the same period.

All of that said, spot rates fell sharply in December after peak season reached its climax and then ended abruptly. BAI Spot rates from Hong Kong to the US East Coast, which had begun the month on 1 December at HK$54.04 per kilo, had dropped to HK$43.39 by 2 January. HK to the US West Coast also dropped precipitously from HK$51.32 per kilo to HK$41.69 over the same period.

Spot rates to Europe showed a similar pattern, falling from HK$48.03 to HK$39.24 during the same period.

Over the month, the full index of outbound routes from Hong Kong (BAI30) – reflecting the whole spectrum of spot and forward contract volumes to all destinations – fell some -11.2% over the four weeks to 5 January. However, it was not down that much from the year before at only -3.9% YoY.

Outbound Shanghai (BAI80) dropped more steeply, after a big decline in the final week over New Year, to be lower by -24.3% month-on-month (MoM). Despite this fall, it was not much lower YoY at -6.1%.

Rates elsewhere out of Asia – such as from Vietnam, South Korea and India – were also mostly falling back at year-end, and remained below the previous year’s levels YoY.

The most significant exception appeared to be Taiwan – a premier exporter of semiconductors – from where rates remained up YoY both to Europe and to the US.

By contrast, rates out of Europe generally held up well in December, although it does not look so great on an annual basis. The index of outbound routes from Frankfurt (BAI20) actually gained +10.8% MoM. But it was still a long way lower at -25.3% YoY, compared to what had been a much higher seasonal peak the previous year.

Outbound London Heathrow (BAI40) was down in December but not that much at -6.9% MoM to leave it at -15.3% YoY.

Out of the US, rates fell steeply in late December and were left a long way below the previous year’s peaks. The index of outbound routes from Chicago (BAI50) declined -29.6% MoM to leave it languishing at -33.9% YoY.

At a macro level, markets ended the year on a relatively positive note. The S&P500 index of leading US stocks gained over +17% YoY, but with the index dominated more than ever by the big US tech stocks such as Nvidia, Alphabet (Google), Amazon, Apple, Microsoft and Oracle.

Over the year, however, US equities were significantly outperformed by stock markets in Europe such as Germany – boosted by higher spending on defence and infrastructure – and the UK (with both the DAX and FTSE 100 indices rising well over +20% YoY). Meanwhile, Japan’s Nikkei 225 index was up over +30% YoY.

These gains were also much greater in real terms versus the US, considering a considerable slide in the value of the dollar last year, which ended -14% against the euro in 2025.

Meanwhile, as confidence sapped from the dollar as a reserve currency, gold soared by about +70% YoY, playing its traditional role as an alternative ‘store of value’.

Surprisingly, the same was not so much true of cryptocurrencies – despite greater legal certainty under the new regime in the US – with bitcoin surging in early 2025, then falling back to end the year more or less flat.

Despite gains outside the US, markets continued to fret about the sheer scale of investment in the AI theme – and whether the AI boom had become a ‘bubble’ about to burst.

There were also rising worries about how much of a lead the US tech giants now held over competitors in China, which seemed to have diminished dramatically over the year.

In the short term at least, the air freight numbers seem to be showing plenty of demand for semiconductors from Taiwan, with market participants positive about a further ‘mini-peak’ expected ahead of Chinese New Year.

Neil Wilson, TAC Editor

Neil Wilson is Editor of TAC Index, which provides independent, accurate and actionable global air freight data, allowing our customers to make comparative, cost-effective and intelligent air freight decisions.

Neil has more than 30 years’ experience in financial journalism and publishing, specialising mainly in derivatives and alternative investments. He has contributed to various publications including The Financial Times, The Economist and Risk magazine. He has also been a guest speaker at many industry events.

Neil has a B.A. with Honours in Philosophy, Politics and Economics from the University of Oxford.

Receive monthly air freight market reports direct to your inbox.