2021 record year for dry freight derivative volumes

The freight derivatives market for dry cargo vessels saw increased traded volumes in 2021, according to data released by the Baltic Exchange.

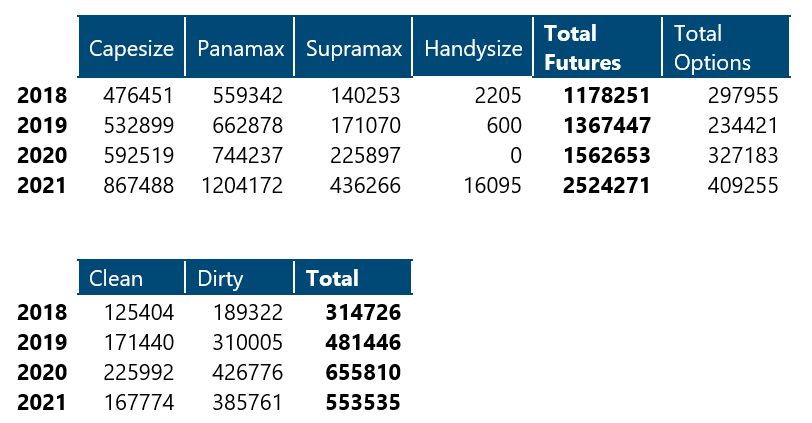

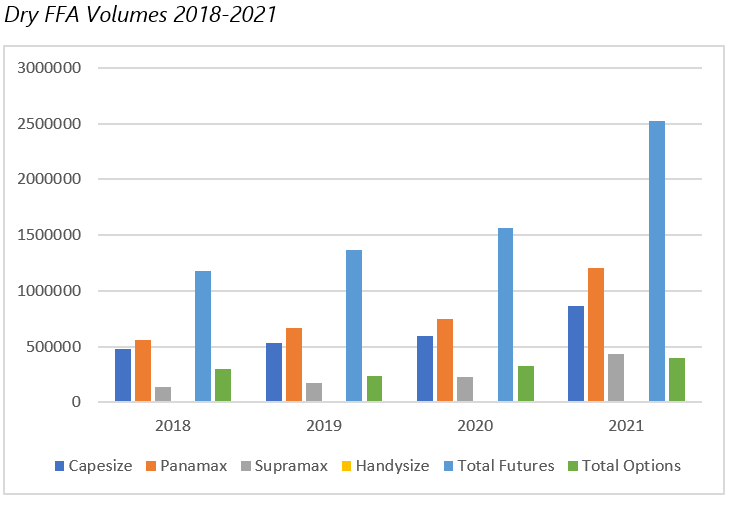

Dry Forward Freight Agreement (FFA) volumes hit 2,524,271 lots, up 61% on 2020. Options trading in the dry market hit an all-time high of 409,255, up 25% on the previous year. The most heavily traded contract was settled against the Baltic Exchange’s panamax timecharter assessment (PTC) which saw 1,202,432 lots traded in 2021.

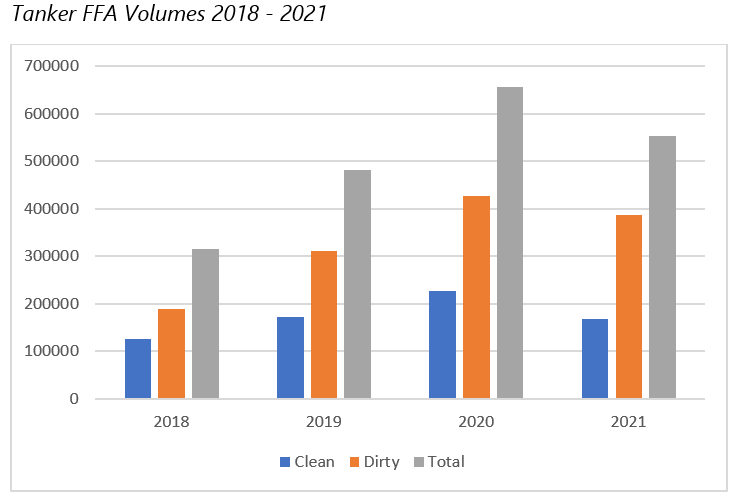

Tanker FFA volumes were down 16% on the previous year, reaching 553,535 lots. Middle East Gulf to China (TD3C) was the favoured tanker contract with 304,719 lots changing hands.

One lot is defined as a day’s hire of a vessel or 1000 metric tonnes of ocean transportation of cargo.

Commenting on the figures, Baltic Exchange Chief Executive Mark Jackson said:

"2021 was another impressive year for the Dry FFA market. Underpinning these volumes are volatility, world class clearing, trust in the Baltic Exchange’s settlement data and increased participation by owners, charterers and traders. Our status as a regulated benchmark provider has allowed more hedge funds and banks to enter this mature, liquid market.”

He added:

"Last year the dry bulk market experienced considerable swings as a result of ongoing supply-chain challenges caused by the Covid-19 pandemic.

With low freight rates, the tanker FFA market was more subdued 2021 due to a lack of sellers. But there are signs of confidence in the market. Our benchmark Middle East Gulf to China crude oil route (TD3C) has open interest going out five years, which shows the excellent depth of this market."

ENDS

For further details please contact Bill Lines, Navigate PR.

T: +44 (0)7970 730521

E: blines@navigatepr.com

Notes to editors

The Baltic Exchange represents a global community of shipping interests. These include shipowners, charterers and shipbrokers who are collectively responsible for handling a large proportion of the world’s dry cargo and tanker fixtures, freight derivative trades as well as the sale and purchase of merchant vessels.

The Baltic Exchange is regulated by the UK’s Financial Conduct Authority (FCA) pursuant to the EU Benchmark Regulation. It is the trusted provider of data for the settlement of physical and derivative freight contracts, underpinning risk management tools for the shipping and transportation markets.

Founded in 1744, the Baltic Exchange is headquartered in London with regional offices in Singapore, Shanghai, Athens, Stamford and Houston.

In 2016 the Baltic Exchange was acquired by Singapore Exchange ("SGX").

Baltic Exchange services:

• Daily benchmarks for dry, wet, container and gas freight markets

• OPEX, S&P, ship recycling & forward assessments

• Air cargo assessments

• Escrow and dispute resolution support

• Executive training via the Baltic Academy

• Networking for shipping professionals