Voyage estimating made even easier with latest expansion of Baltic Exchange’s bunker report

From owners and operators to charterers and brokers, the need to make critical data-driven decisions when it comes to time charter equivalent (TCE) calculations is vital to maximise a vessel’s potential earnings. This is the case for vessels on either the spot or futures market as expenses related to port fees, insurance and crew costs all impact overall profitability.

Bunkering costs traditionally account for more than half of a vessel’s operating expenses and are particularly susceptible to market volatility and supply chain challenges.

Baltic Exchange has provided key insights to its members with its Baltic Bunker Report, which was launched in January 2022 in direct response to member requests for greater data on bunker fuel costs at key bunkering hubs.

As the bunker market continues to mature, Baltic Exchange is adapting to greater demand for data and insights in newer markets to cover more fuel options. As a result, Baltic Exchange is pleased to announce it is now providing Bunker Indices on a daily basis and has added three new bunkering ports in order to provide reliable, up-to-date marine fuel price indications. This information is provided free of charge to members.

Baltic Exchange’s new Bunker Report, which is published Monday to Friday, will help members navigate the volatile fuel markets by offering spot price assessments for High-Sulfur Fuel Oil (HSFO), Very Low-Sulfur Fuel Oil (VLSFO), and Marine Gas Oil (MGO). Ports covered now include Gibraltar, Panama, and Zhoushan, alongside Rotterdam, Houston, Singapore, and Fujairah.

Compiled through contributions from a network of respected bunker brokers and traders, the report offers a snapshot of real-time market conditions, supporting commercial decision-making for fuel purchasing, voyage planning, and contract negotiations.

“In an industry where bunker costs can represent a significant proportion of voyage expenses, access to timely and accurate pricing is crucial,” said Matthew Cox, Benchmark Production Head at Baltic Exchange.

“Our members can use these prices as a reference in charterparty negotiations, to inform bunker purchasing strategies, or even to help resolve disputes around consumption claims. This is quality data that others in the market may pay heavily for, but we are offering it as part of our commitment to deliver valuable resources free of charge to our membership.”

The report provides trusted price indications from active market participants on key Baltic trade routes.

“With the growing complexity of fuel markets and regulations, it’s more important than ever that the maritime community has access to transparent, reliable price information,” said Matthew Cox. “The latest expansion of our bunker report coverage, which provides data on new, developing bunkering hubs, also complements our wider suite of data products, including the ETS Allowance Price Report, FuelEU Maritime Calculator, and Fuel Equivalence Converter, all of which are designed to help our members stay informed and make smarter commercial decisions.”

As with all of its service offerings, Baltic Exchange encourages feedback from members and the wider market to help shape future developments of bunker reporting, with the aim of continually improving the service and ensuring it meets the evolving needs of the shipping industry. If you would like to find out more or have any feedback, please contact us at balticbroker@balticexchange.com

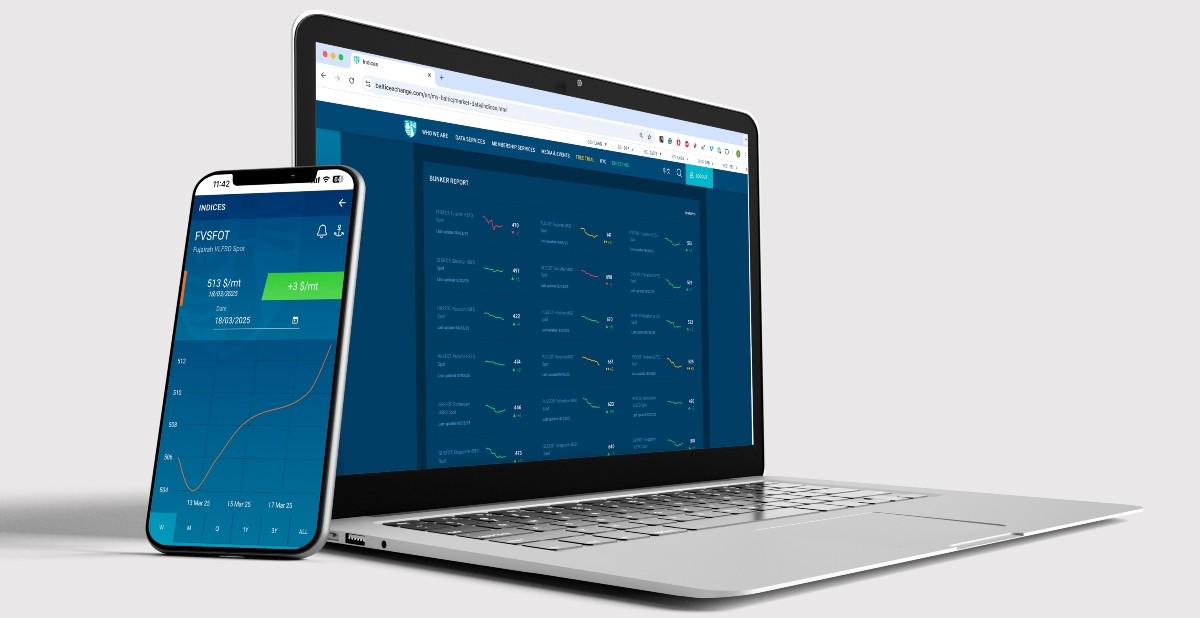

Baltic Exchange’s daily bunker report is available through the ‘Market Data’ section of My Baltic, accessible via both the Baltic Exchange website and Baltic App. Members who do not yet have an individual login can register at no additional cost if their company already holds a Baltic membership.

Be sure to sign up for your free, daily insight into global marine fuel prices today.